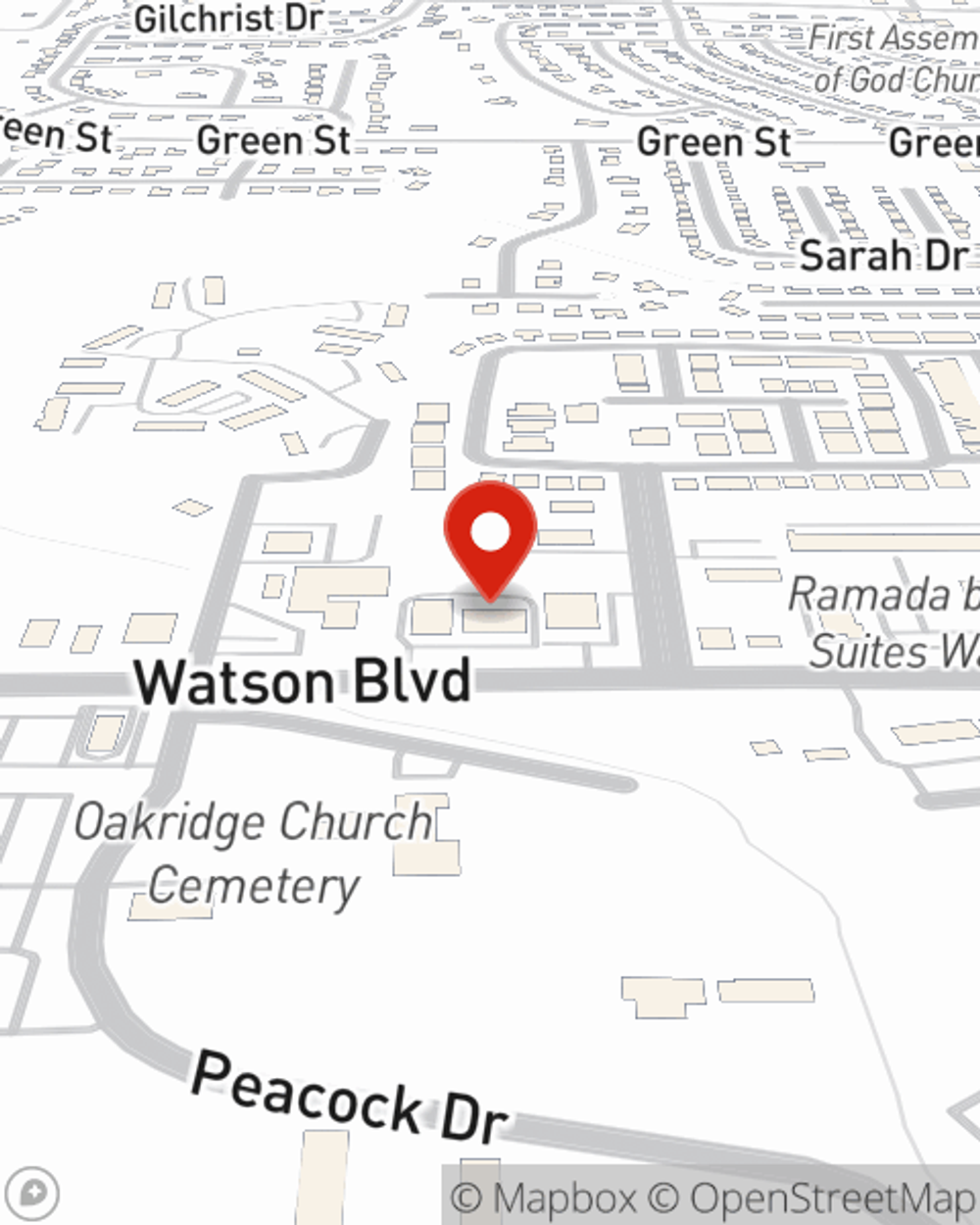

Business Insurance in and around Warner Robins

One of Warner Robins’s top choices for small business insurance.

Helping insure small businesses since 1935

Your Search For Excellent Small Business Insurance Ends Now.

Being a business owner is about more than being your own boss. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for those you love. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with extra liability coverage, a surety or fidelity bond and business continuity plans.

One of Warner Robins’s top choices for small business insurance.

Helping insure small businesses since 1935

Get Down To Business With State Farm

Whether you own a farm supply store, an antique store or a toy store, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call or email agent Eddie Causey to explore your small business coverage options today.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Eddie Causey

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.